Where “Eureka!” Meets “Cha-Ching!”

Is your company continually finding ways to improve its business processes? Have you made a product or service better, faster, or more cost-effective?

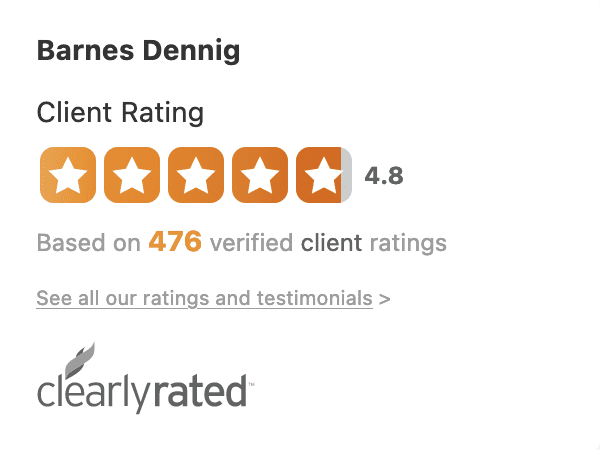

If you think, “Oh, that’s just part of the job,” think again. The U.S. tax code offers an incentive for companies that innovate: the Research & Experimentation (R&E) tax credit. You could qualify for a share of the roughly $9 billion awarded yearly.

And, if you’re eligible, the Barnes Dennig tax team can help you secure it.

We’ll get to know your business and processes and help you identify what could qualify for the R&E tax credit, as well as advising on how to quantify the credit and implement best practices to track R&E projects and expenses.

How it works

The wage-based R&E tax credit is generous. It covers:

- Part of the wages for employees who directly contribute to R&E

- Supplies and software used for R&E activities

- Contracted R&E services

There are so many ways to qualify for this credit, including:

- Internal-use software development

- Prototype and destructive testing

- Development of new products, or improvements to existing ones

- Development of manufacturing processes

- Research on new materials to be used in production

- Equipment component and design

- Design and testing of equipment and machinery that results in increased uptime, improved quality, and reduced cycle time

- Development of jigs and in-house-created tooling and fixturing

Best of all, your company can claim R&E credit for all open tax years, which generally means the past three years as well as the current year. You can also carry the credit forward up to 20 years — a valuable benefit if your company is operating at a net loss.

How we help

The tax professionals at Barnes Dennig will do far more than help you file for R&E credit. By monitoring legislative changes that impact the tax code, and understanding their impact, they’ll help you get all the credits you’re eligible for and plan for future credits.

Learn more

Contact us to make your innovations and improvements more rewarding.