Doing Good Makes Good Business Sense

They say that virtue is its own reward. But sometimes it’s not the only one.

Has your company recently hired a veteran? Created new jobs? Converted to LED lighting? The tax code rewards economic actions that benefit society as well as business. These tax credits and incentives could help your company reduce its tax burden.

But tax laws are complex and ever-changing. How can you be sure you’re getting all the savings you’re entitled to?

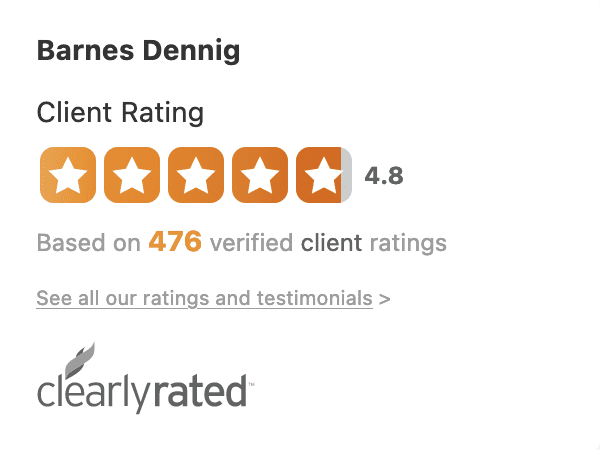

Consult the tax professionals at Barnes Dennig.

The fine art of tax credit planning

Because states and local municipalities compete for your business, they offer credits and incentives for building a strong workforce. We help companies like yours secure tax savings in the form of:

- InvestOhio tax credits

- Job Creation Tax Credits (JCTC)

- Work Opportunity Tax Credits (WOTC)

- Various training grants

- Property tax reductions or abatements

- Sales tax minimization

- Safety Intervention Grants

- Tax breaks for energy-efficient improvements

- Commercial Activity Tax planning

- Research & Experimentation Tax Credits

- Historic Preservation Tax Credits

How we help

Barnes Dennig tax professionals have spent years cultivating close relationships with government and economic development agencies. So they can stay on top of relevant new tax programs and make sure your company is taking advantage of them.

Thinking about making an important capital investment? Contact us to see if you’re eligible for a tax incentive that could boost your ROI.