Develop Success Beyond Your Next Investment

In commercial real estate, bigger is often better. But bigger projects also add complexity. Taxes are tougher. You’re juggling more relationships with investment partners. The fluctuating market poses a constant risk.

Still, you have to minimize your tax burden, balance your books, and manage your leverage. And, to stay competitive, you must be able to look ahead.

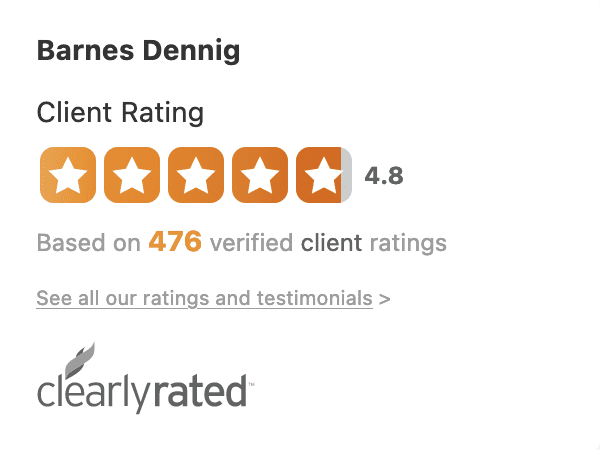

Barnes Dennig understands. We have the accounting, tax, and real estate experience to help make it all possible.

Let us handle the details

Barnes Dennig’s cross-functional real estate team puts a wealth of CPA, legal, and tax experience at your fingertips. Our professionals know how to keep companies like yours compliant and running smoothly.

Rely on us for:

- Tax compliance

- State and local tax including sales and use tax

- Tax planning

- Maximizing tax deductions for development costs

- Subdividing real estate tax rules

- Tax-free exchanges of real estate

- Cost segregation studies

- Accounting

- Audits, reviews, and compilations

- Acquisition issues

- Business valuation

- Buy-sell agreements

- Affordable Housing HUD Audits

- Cash flow management

- Owner succession and estate planning

- Income recognition determination

- Purchase/lease option analysis

- Litigation support

- Employee Benefit Plan audits

- Entity selection for real estate holdings

We help you see beyond the numbers

To thrive over time, you need to think strategically. That’s where Barnes Dennig stands apart from other CPA firms. We keep a sharp eye on the trends shaping commercial real estate, and we show you opportunities others miss. Year after year, our in-depth insights will power your success.