Barnes Dennig works with established and mature corporate clients on international tax issues.

International Tax Accountants – Richmond (VA)

Richmond and Virginia businesses with international operations, investments, or partnerships often face a myriad of regulatory, tax, and financial reporting challenges. Not only do these businesses need to satisfy local, state, and national tax authorities, but there is an added layer of compliance when attempting to navigate foreign rules and regulations. The same types of issues exist for international businesses expanding to Virginia when navigating U.S. rules and regulations. To complicate the situation, the recently proposed international tax changes made by the Biden Administration are certain to significantly impact tax planning, structuring, and reporting. The result is a hyper-complicated regulatory landscape that requires careful planning, attention, and structuring to navigate.

Richmond and Virginia businesses with international operations, investments, or partnerships often face a myriad of regulatory, tax, and financial reporting challenges. Not only do these businesses need to satisfy local, state, and national tax authorities, but there is an added layer of compliance when attempting to navigate foreign rules and regulations. The same types of issues exist for international businesses expanding to Virginia when navigating U.S. rules and regulations. To complicate the situation, the recently proposed international tax changes made by the Biden Administration are certain to significantly impact tax planning, structuring, and reporting. The result is a hyper-complicated regulatory landscape that requires careful planning, attention, and structuring to navigate.

Barnes Dennig provides international tax planning, compliance, structuring, and assurance services to Virginia companies with international operations, foreign companies with a U.S. presence, and to those that source, sell, or license products outside of their country of origin. Not only do we help with regulatory matters, but we also work closely with management on more complicated issues such as transfer pricing and entity structuring.

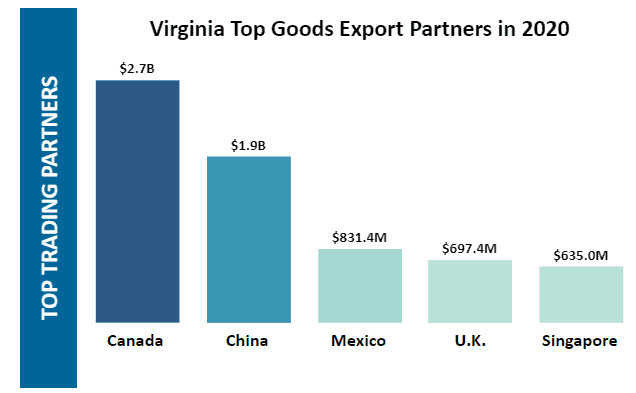

Virginia Trade Export Data

Richmond International Tax Services

Barnes Dennig provides a unique combination of deep international experience with focused and personalized attention. For small companies beginning to scale up, our team can guide you as your needs grow more sophisticated. For those that have already reached a multi-national status, we can assist with:

- Tax treaties

- Cost-efficient taxation of foreign income

- Asset disclosures

A wide array of inbound and outbound businesses rely on us for help with:

- Global entity structuring IC-DISC

- Foreign Tax Credit (FTC) planning

- Transfer pricing

- U.S. Subsidiary Reporting

- Foreign Operations

- Foreign Bases of Accounting

- Foreign Currency Reporting and Hedging