2025 Manufacturing, Wholesale/Distribution Compensation & Benefits Study: Key Takeaways & Trends

Published on by Matt Rosen in Manufacturing, Wholesale / Distribution

With record-breaking participation and sharp insight into the region’s evolving labor and benefits landscape, the 2025 Manufacturing and Wholesale Distribution Compensation & Benefits Study provides a timely snapshot of how businesses are adapting and preparing for what’s ahead.

Record participation, expanding reach

This year’s study, presented by Barnes Dennig, Custom Design Benefits, and AMIP, saw its highest participation yet. A total of 107 companies took part, a notable increase from the mid-80s just two years ago.

The study’s key trends underscore the ongoing importance of benchmarking and collaboration in a complex business environment.

Participants ranged widely in industry representation, geography, and size:

- 75% were manufacturers, the rest were wholesalers and distributors.

- Around 25% were private equity-owned.

- Half are based in the Greater Cincinnati/Dayton area, while the rest operate nationally or internationally.

- Revenue and employee size varied, but most had fewer than 250 FTEs and $100 million in revenue.

The economic outlook: guarded optimism

Survey data was collected in March-April 2025 and reflected a conservative outlook, given the economic and geopolitical volatility the year has brought:

- 60% of companies expected flat or sub-5% gross margin growth.

- The biggest cost pressure cited: raw materials (45%), labor (20%), and limited pricing power.

More than 50% of companies reported raw material cost increases over 6%, but only 31% raised prices by that amount, highlighting continued margin compression.

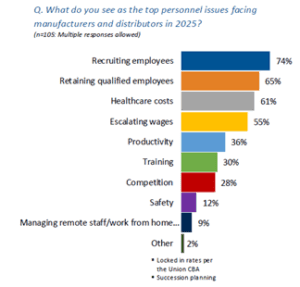

Workforce trends: talent remains a top concern

While the economic outlook was cautious, workforce challenges remain firmly in focus.

- Recruiting and retaining qualified employees are again the top personnel concerns.

- Turnover remains steady compared to 2023 but is concentrated at lower-level positions.

- Wage pressure is easing, as increases anticipated for 2025 are lower than increases provided in 2024.

Nearly three-quarters of companies named recruiting as their #1 challenge, closely followed by retention.

Compensation snapshot: benchmarking executive pay

The presentation shared high-level compensation data across more than 20 common roles in the industry from CEO to Warehouse Workers, showing total compensation (base + bonuses + commission). The data is further broken down by role, industry type, and company size for meaningful comparisons.

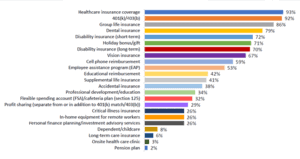

Benefits evolution: trends from custom design benefits

The survey also highlights key shifts happening in employer-sponsored benefits:

- 93% of companies offer health insurance, including family members.

- The region is split between self-insured (50%) and fully insured (45%) plans, slightly behind the national trend toward self-funding.

Some hot topics to watch in employee benefits include:

- Onsite/Near-site Clinics: Emerging as cost-effective care hubs.

- Reference-Based Pricing (RBP): A strategy gaining traction for tying reimbursements to Medicare benchmarks.

- Pharmacy Costs: A major (and growing) concern, particularly with the rise of specialty medications.

The majority of employers are enhancing wellness programs and considering onsite clinics or RBP models to rein in costs.

Emerging benefits: expanding beyond the basics

Employers are also evolving their benefit offerings to meet shifting employee expectations:

- Lifestyle Spending Accounts (LSAs) are becoming more common, supporting everything from fitness equipment to student loan assistance.

- Mental health benefits are expanding, including teen-specific virtual care and crisis support resources.

- Personalized wellness programs are being driven by claims data to improve long-term cost management.

Benefits offered by participating companies

Keep reading for further insights

The 2025 Manufacturing and Wholesale/Distribution Compensation & Benefits study offers a timely lens on the pressures and progress shaping regional manufacturing and distribution. From evolving benefits strategies to stabilized wages and persistent hiring challenges, the landscape is complex, but full of opportunity for companies ready to adapt.

Looking for more insights? Download the full 2025 Compensation & Benefits Report and presentation slides to explore all the data, trends, and strategies shaping the year ahead. Questions about any of the data in the report? Contact one of our industry experts. As always, we’re here to help.