Stronger Together: Fractional Teams and State & Local Tax Strategies in Sync

Published on by Jill Prendergast, Cheryl Ganim, in State Local Tax, Tax Services

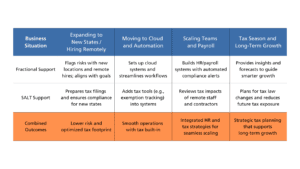

By working together, Fractional and SALT professionals deliver integrated solutions that increase efficiency and value, maximize resources, reduce costs, and help your business thrive.

Fractional Accounting and Advisory Services refer to financial and accounting professionals who offer their expertise and services on a recurring scheduled basis. The right fractional resource or team can help ensure strategic alignment and accuracy, giving you and your stakeholders peace of mind – so you can focus on growth, make informed financial decisions and position your organization for success in both the short- and long-term.

State and Local Tax (SALT) Advisory Services focus on external tax compliance, charting a course through complex state and local income and sales tax regulations, and helping you qualify for multi-state tax credits, incentives, and refunds. Our team assists businesses with determining state tax nexus for income, franchise, and sales tax, voluntary disclosure programs, state tax registrations, tax research, taxability of your products and services by state, and ongoing outsourced sales tax compliance.

When these teams coordinate efforts across compliance, planning, and client service, they provide a more strategic, cohesive experience that benefits your business – integrated workflows, effective use of technology, and alignment on best practices are a few of the benefits the collaboration provides.

Aligning expertise

Coordinated planning between Fractional and SALT supports your business growth. Joint meetings and quarterly reviews uncover tax exposure and growth opportunities, and knowing your providers are working hand in glove deepens trust and facilitates strategic discussions between segments of your business that could otherwise be missed.

Internally, cross-training, shared messaging, and streamlined processes enable teams to understand one another’s priorities and recognize key triggers and red flags that could save your business from costly penalties and fines. Service bundling also enhances your value by combining compliance support with insights and planning.

Connecting through technology

When your systems work together, your business works smarter. Integrating tools like your tax engine with Enterprise Resource Planning (ERP) platforms, such as NetSuite, SAP, or Microsoft Dynamics, helps improve communication, align your teams, and deliver higher-quality insights. Even platforms like QuickBooks Online (QBO) can connect seamlessly with tax technology, giving business owners clearer visibility and more time to focus on growth.

Key outcomes include:

- Streamlined compliance processes and reduced risk.

- Shared access to real-time data.

- A centralized client record to support consistency.

- Tools that enhance client interaction and reveal planning opportunities.

Well-integrated systems create a foundation for proactive, rather than reactive, service.

Improving workflow efficiency

Automation and centralization enable scalable, repeatable processes that reduce manual workload and increase visibility. Targeted automation for tasks like sales tax filings and monthly close processes shortens turnaround times and improves accuracy.

Building connected systems and introducing rules-based alerts can help teams stay aligned and avoid critical gaps in workflows. As more businesses adopt integrated platforms and automate routine tasks, they create space for their teams to focus on cross-functional strategy, advisory conversations, and risk mitigation, driving greater value and reducing costs.

Technology best practices

Recommended:

• Link tax engines with ERP systems.

• Maintain a centralized digital repository for exemption certificates.

• Use a standardized tech stack across teams.

• Automate multistate filings to reduce errors and missed deadlines.

• Minimize manual processes to lower audit risk.

Avoid:

• Tracking economic nexus manually.

• Trying to meet every client need without specialization.

• Operating in disconnected team silos.

• Overlooking the importance of data quality and mapping.

• Delaying system reviews.

• Using automation as a substitute for human insight.

How Barnes Dennig can help

When your business is growing rapidly, keeping up with the nuances is challenging, and the consequences of falling out of compliance can be steep. Combining the expertise of sales tax professionals and fractional accounting and advisory services is a game-changer – protecting your business and helping it thrive while providing you with greater peace of mind.

Want to know more? Here’s an overview of how the fractional model works. You may also be interested in our CFO Guide to Success or Fractional Accounting and Advisory FAQ. And, explore Top 10 Triggers for Sales Tax Nexus – a few of them are jaw-dropping – and hear from our leading sales tax compliance pros on common sales tax pitfalls (and how to avoid them).

Wherever you are in your business growth journey, our top fractional and sales tax professionals are here to help. Contact us for a free consultation, and start building your better, brighter future today.