Don’t Mess with Taxes

You have the wisdom to hire tax professionals to file your company’s returns. And although there’s never been a problem, per se, you can’t help wondering:

“Why don’t they know more about my industry?”

“Why don’t I hear from them more than once or twice a year?”

“My taxes seem so high; aren’t there any other ways for me to reduce them?”

The tax code is full of opportunities for companies like yours, but it takes a different kind of tax firm to find them. Meticulous. Strategic. Focused on you.

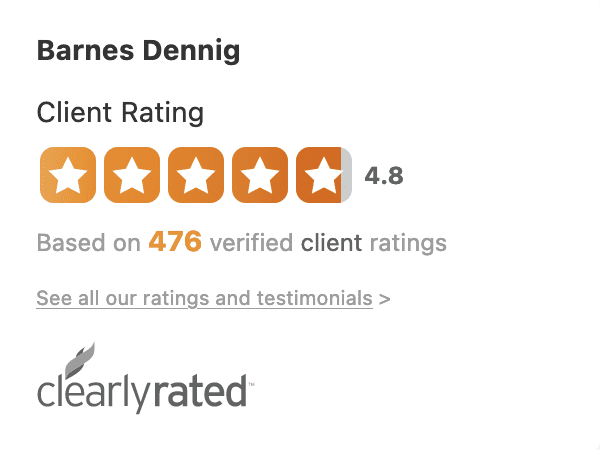

A tax firm like us: Barnes Dennig.

Delegate the details

However large (or small) your company is, we have the skills and experience to hit the ground running and start delivering results.

We know the tax code inside and out – and understand how and where it creates opportunities for you. We have the in-depth industry knowledge to get you every tax advantage your company is entitled to. We’ll manage all the critical tasks involved in achieving compliance while looking for ways to minimizing your tax burden.

Benefit from innovative insights

The real secret to our clients’ success lies in the way we think.

When it comes to thought leadership, Barnes Dennig tax professionals stand out among their peers. Always up to date on tax laws and industry trends, they generate exciting ideas and share them widely. They’re creative problem-solvers whose work sets the bar for others. Think what their focused insights could do for your business.

Barnes Dennig tax professionals are visionary. They see beyond the numbers to the opportunities they present. And year after year, they’ll show you how to use those opportunities to your advantage.

What we do

Call on Barnes Dennig for help with: