Strategic Planning for Wholesalers & Distributors in the COVID-19 Era

Published on by Bryan Gayhart in Consulting, COVID-19, Wholesale / Distribution

It’s safe to say that the challenges your business faced at the end of 2019 were very different than the challenges your business faces today. COVID-19 is unlike anything most of us have ever experienced, and it has brought new challenges to your business as we’re all forced to change the way we operate and how we interact with our employees, our customers and our suppliers. Despite the challenges, COVID-19 has also presented opportunities. Companies that are willing to embrace the challenges and changes from COVID-19 will be set up for success as we come out of the pandemic and get comfortable with the new normal. Here are four key areas to focus on as the new normal unfolds.

Forecasting and Situational Planning

Before you can focus on creating opportunities it’s critical to understand where your business is at today. Stress-test your business under various revenue levels and situations. Analyze your budget for these scenarios and think critically about the impact potential reductions in revenues will have on your company. Will you need to reduce headcount or salaries? Are there leases that can be renegotiated or modified? Are there other areas of my business where I can reduce costs? Those are just a few of the questions you’ll have to consider as you analyze your business at different revenue levels.

What-if

At some point the pandemic will wind down, and when that happens the competitive landscape will look much different. It’s possible you’ll see big swings in market share. Consider the what-ifs and focus on scenario planning. How would you react to certain events such as:

- Significant supplier or customer goes out of business.

- A competitor’s top supplier or customer goes out of business.

- A new region or territory becomes available through merger or acquisition.

- A service company that has a complementary offer becomes available as a merger or acquisition.

Having a game plan and being prepared for these types of situations will allow you to execute efficiently and effectively should these situations occur.

Strategic Planning

When business is cruising along smoothly there is less interest in making changes. Change is tough, and more often than not it takes times of disruption for companies to implement changes.

Use this time to evaluation your organizational structure. Do you have the right leaders in place? Are there bottlenecks in certain areas of the company? With changes to the sales process do we have the right people and the right types of selling roles to meet the expectations and demands of our customers?

Consider reviewing your pricing strategies. Do you treat every customer like an A customer? Do you know your margins per customer and per product? Is every order treated like an emergency order?

Analyze your costs. Do you know the all in cost of picking, packing and shipping a product? Could you be saving money on freight or product purchase quantity?

Innovation

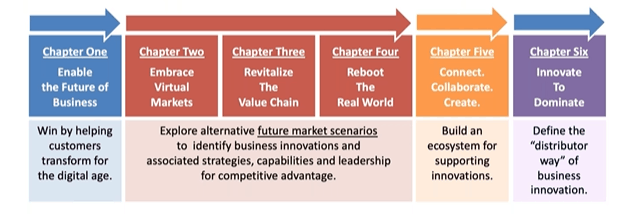

The National Association of Wholesaler-Distributors (NAW) has released their 12th edition in the Facing the Forces of Change Series, and the timing is perfect as innovation and leveraging technology are critical to driving growth and creating new opportunities. The book is built around a roadmap for innovation covering six main topics:

Additional Resources

Have questions about your business? Talk to one of our Barnes Dennig wholesale distribution industry experts to ensure you’re optimizing your business for success.

What should you do?

First, keep in mind that market downturns sometimes offer the chance to pick up potentially solid stocks at value prices, which could position a portfolio well for future growth. Again, there are no guarantees that stocks will perform to anyone’s expectations — and decisions could result in losses including a possible loss in principal — but it may be helpful to remember that some investors use downturns as opportunities to buy stocks that were previously overvalued relative to their perceived earnings potential.

Moreover, if you typically invest set amounts into your portfolio at regular intervals — a strategy known as dollar-cost averaging (DCA), which is commonly used in workplace retirement plans and college investment plans — take heart in knowing you’re utilizing a method of investing that helps you behave like the value investors noted above. Through DCA, your investment dollars purchase fewer shares when prices are high, and more shares when prices drop. Essentially, in a down market, you automatically “buy low,” one of the most fundamental investment tenets. Over extended periods of volatility, DCA can result in a lower average cost for your holdings than the investment’s average price over the same time period.

Finally and perhaps most important, during trying times like this, it may help to focus less on daily market swings and more on the fundamentals; that is, review your investment objectives and time horizon, and revisit your asset allocation to make sure it’s still appropriate for your needs. Your allocation can shift in unexpected ways due to changes in market cycles, so you may discover the need to rebalance your allocation by selling holdings in one asset class and investing more in another. (Keep in mind that rebalancing in a taxable account can result in income tax consequences.)

Questions?

After considering the points here, if you still have questions about how changing market dynamics are affecting your portfolio, call us at 513-241-8313 or click here to contact us. We look forward to hearing from you. Often another professional perspective can help alleviate any worries you may still hold.

1Based on data reported in WSJ Market Data Center, February 28, 2020, and March 2, 2020. Performance reflects price change, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.