Does Your Employee Benefit Plan Shout “Quality!” to the DOL?

A solid employee benefit plan is among your company’s most valuable assets. It enables you to attract and recruit the best talent. It boosts the job satisfaction of current employees, making them more productive and more likely to stay with you.

But it’s your fiduciary responsibility to prove you’re administering your plan wisely, in compliance with US Department of Labor (DOL) regulations. This means — you guessed it — an audit, required by DOL and conducted by a quality auditor.

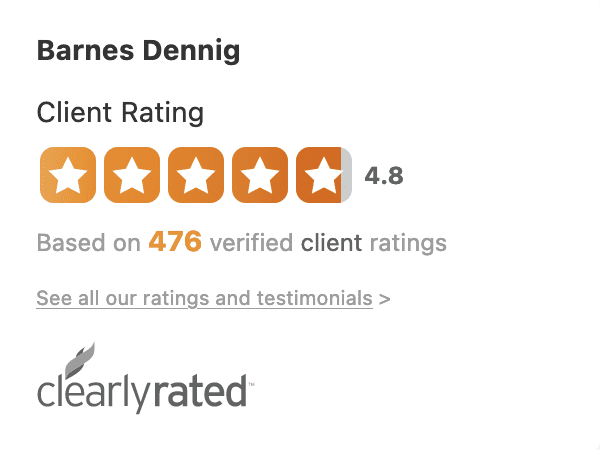

That’s why you should call us: Barnes Dennig.

Can’t watch the video? Get the transcript.

Compliance is complicated

Every year, your benefit plan has to meet the complex requirements set by the DOL and the Employee Retirement Income Security Act (ERISA). And those requirements are constantly changing.

Barnes Dennig makes it simpler

Our team of professionals will help you align with DOL regulations, giving your employees the assurance they need. We’ve earned a reputation among our clients and peers for our:

Experience

Barnes Dennig is one of the country’s Top 100 firms for employee benefit plan auditing. Perhaps not surprisingly, we are members of the AICPA Employee Benefit Plan Audit Quality Center. The members of our EBP team hone their skills by performing more than 170 plan audits a year.

Versatility

Our experience goes beyond the 401(k) audit, and includes:

- 401(k)

- 403(b)

- Profit-sharing plans

- Defined benefit plans

- Employee Stock Ownership Plan (ESOPs)

- SEC 11-K Filings

- Health & welfare plans

- Full-scope audits

- Limited-scope audits

- Plan mergers, acquisitions, and spin-offs

- Full or partial plan terminations

- Initial audits and stub period audits

- DOL and IRS investigation assistance

- ERISA compliance matters

- Form 5500 and Form 990 or 990 T filings

Objectivity

At Barnes Dennig, we do EBP audits. No plan administration, no human resource consulting — which means no conflicts of interest. That’s what makes our audits the ones you and your employees can trust.

Membership: AICPA Employee Benefit Plan Audit Quality Center

Get the latest 401(k) Plan Management Benchmarking Report

Download the report, and then set up a free consultation with one of our top employee benefit plan audit pros.